This Week in the Markets: A Daily Breakdown

Monday – 3.10.25

Gold and silver experienced slight pullbacks as some market participants took profits, but weakness in equities provided support. April gold settled at $2,911.90 (-$2.20), while May silver eased to $32.63 (-$0.179). Meanwhile, recession concerns deepened as U.S. stocks tumbled and President Trump acknowledged a “period of transition” amid escalating trade tariffs.

Tuesday – 3.11.25

Gold and silver roared higher as safe-haven demand returned, fueled by recession fears and a declining U.S. dollar. April gold jumped to $2,922.90 (+$23.30), and May silver climbed to $33.23 (+$0.70). Stocks slid to multi-month lows after fresh tariffs on Canadian goods shook confidence.

Wednesday – 3.12.25

Gold and silver extended gains as U.S. inflation data came in softer than expected. April gold reached $2,941.30 (+$20.40), while May silver moved up to $33.68 (+$0.538). The February CPI print of 2.8% year-over-year, slightly below expectations, weakened the dollar and supported metals.

Thursday – 3.13.25

Gold surged to a new record, driven by soft inflation data and ongoing global trade tensions. April futures hit $2,990.30 (+$43.60), and silver followed, reaching a 4.5-month high at $34.30. The Producer Price Index (PPI) for February was flat, reinforcing the idea that inflation is moderating—at least for now.

Friday – 3.14.25

Gold officially cracked $3,000, hitting a peak of $3,017.10 (April Comex futures) before settling at $3,008.60 (+$17.30). Silver kept pace, closing at $34.73 (+$0.424). A combination of trade war concerns, a dovish shift in Fed expectations, and strong technical momentum propelled metals higher.

Gold at $3,000: What’s Behind the Surge?

The surge in gold prices isn’t a temporary anomaly—it’s a reflection of a rapidly shifting economic landscape. Gold has long been a barometer of financial stability, and its latest rally is a signal that global markets are preparing for prolonged uncertainty.

Key Drivers Behind Gold’s Breakout:

✔ Historic Breakthrough – Gold’s ascent past $3,000 marks one of the most significant price milestones in history. Just a year ago, gold struggled to hold above $2,000. Today, it’s up nearly 15% year-to-date, underscoring how quickly the global appetite for real, tangible assets has grown. As market participants move away from paper assets and fiat currencies, gold’s value proposition is stronger than ever.

✔ Inflation Easing—but the Damage is Done – February’s Producer Price Index (PPI) rose 3.2% year-over-year, down from January’s 3.7%, suggesting that inflationary pressures are moderating. However, core inflation remains stubbornly high, with sticky prices in shelter, energy, and wages continuing to weigh on the economy. A “cooling” inflation rate still means higher costs for consumers and a weaker dollar in real terms, which only reinforces gold’s appeal as a long-term hedge.

✔ Federal Reserve’s Balancing Act – The Fed is stuck between a rock and a hard place. On one hand, inflation is showing signs of softening, but keeping rates high for too long could trigger a severe economic slowdown. While the Fed is expected to hold rates steady in its upcoming meeting, market participants are already betting on future rate cuts by mid-year. Lower interest rates reduce the appeal of yield-based investments, making gold even more attractive in comparison.

✔ Geopolitical Tensions and Economic Uncertainty – From ongoing U.S.-China trade disputes to global supply chain disruptions and banking concerns, the world is navigating a period of immense financial instability. Political uncertainty in the U.S., particularly as we head into an election year, is further adding to the flight toward safe-haven assets. Historically, gold thrives when confidence in government stability and fiscal policy begins to wane.

✔ Central Bank Demand at Record Highs – Global central banks are accumulating gold at an unprecedented pace, led by China, Russia, and India. Many nations are actively reducing their dependence on the U.S. dollar, turning to physical gold reserves as an alternative store of value. This sustained demand is adding further upward pressure to gold prices, making pullbacks in price short-lived.

The Takeaway:

Gold’s surge past $3,000 is not just a technical breakout—it’s a direct reflection of growing financial instability, government mismanagement, and economic fragility. The message is clear: gold remains the ultimate hedge against currency devaluation, inflation, and systemic risk. Those still sitting on the sidelines are watching history unfold, and those who own physical gold are seeing the value of their wealth preserved.

U.S. Dollar Faces Worst Year Since 2008 Amid Tariff Fallout

The U.S. dollar is in free fall, experiencing its steepest decline in 17 years. Since January, the Dollar Index has dropped 4.2%, a downturn reminiscent of the 2008 financial crisis. While a weaker dollar can boost exports, it comes at a cost—higher inflation, reduced purchasing power, and heightened market volatility.

What’s Driving the Dollar’s Slide?

✔ Tariff Fallout – The U.S. has imposed new tariffs on Canadian and Mexican goods, triggering retaliation fears and market jitters. The euro, by contrast, has surged 4.5% in just one week, highlighting the global shift away from the dollar.

✔ Interest Rate Uncertainty – Just a month ago, markets were pricing in one rate cut by year’s end. Now, expectations have risen to three cuts, signaling concerns over economic weakness. A looser monetary policy makes the dollar less attractive to global investors.

✔ Inflation Risk on the Rise – A weaker dollar means higher costs for imported goods, which only adds pressure to already strained household budgets. Combined with lingering supply chain disruptions, the threat of persistent inflation is growing.

The Big Picture: Why This Matters for Gold & Silver

A declining dollar historically fuels gold and silver rallies. As the greenback weakens, people turn to hard assets that retain real value. The trend is already playing out—gold has surged past $3,000, and silver is pushing toward $35 per ounce.

If the dollar’s slide continues, expect gold and silver to extend their gains, making now the time to secure physical metals before the next price surge.

Gold Holds Strong Despite Cooling Producer Prices

Market analysts have been quick to point out that producer prices came in softer than expected in February, but a closer look at the data reveals why gold’s upward momentum remains intact.

✔ Producer prices were flat month-over-month, missing expectations of a 0.3% increase. On the surface, this may suggest inflation is cooling, but the reality is that prices remain significantly elevated compared to pre-pandemic levels.

✔ Core PPI dipped 0.1%, which is lower than forecasts. However, this decline does little to erase the inflationary pressure of the past three years. The damage to purchasing power has already been done, and gold remains the go-to asset to protect against the long-term effects of monetary debasement.

✔ Spot gold continues to defy expectations, trading at $2,944.80 (+0.37%), even as some analysts expected a pullback. The strength of gold’s price action in the face of soft inflation data reinforces its status as the preferred wealth preservation tool for market participants worldwide.

What This Means for Gold’s Future:

If inflation continues to slow, the Fed will have even more room to cut interest rates in the coming months. This would make gold an even more attractive alternative to cash and bonds, leading to higher demand and potentially sending prices beyond the $3,200 mark.

What’s Next for Gold? Fed, Inflation, and Trade War Uncertainty

Gold’s trajectory for the next quarter will be dictated by three major factors:

✔ Federal Reserve Meeting (March 19): Will the Fed acknowledge economic weakness and hint at future rate cuts? If Powell’s language leans dovish, gold could see an explosive rally.

✔ Trade War Escalation: The U.S. has imposed fresh tariffs on Canadian goods, with potential retaliation from Canada and the European Union on the horizon. Trade wars historically weaken global economic growth and increase demand for gold as a safe-haven asset.

✔ The U.S. Dollar’s Decline: The dollar index has dropped 4.2% year-to-date, and if the Fed shifts toward an easing cycle, this trend could accelerate. A weaker dollar makes gold even more valuable on the global stage, as it remains the ultimate currency hedge.

How High Can Gold Go?

If current conditions persist, $3,200 to $3,400 is well within reach in the coming months. However, if a recession takes hold or the Fed is forced to aggressively cut rates, we could see $3,500+ gold by year-end. The trend is clear—those holding physical gold are in a position of strength.

Silver: The Sleeper Play Amid Market Turmoil

While gold is dominating headlines, silver has quietly been outperforming and gaining momentum.

✔ Silver prices are up 2% on the day, with technical resistance at $35 per ounce.

✔ The largest silver miner ETFs are surging, with SIL (Silver Miners ETF) up 3.5% and SILJ (Junior Silver Miners ETF) up 4.9%.

✔ Industrial demand for silver is soaring, thanks to its crucial role in solar panels, electronics, and the rapidly expanding green energy sector.

Why Silver Could Outperform Gold

Unlike gold, which is primarily a monetary metal, silver has a unique dual-purpose role—serving both as a store of value and as an essential industrial component.

✔ A Silver Supply Crunch is Developing – Global silver production is struggling to keep up with demand, and the U.S. Mint has faced repeated supply chain issues in sourcing silver for coin production.

✔ Silver-to-Gold Ratio Favors Upside Potential – Historically, silver trades at a ratio of around 50:1 to gold. Today, that ratio stands at 85:1, indicating silver is significantly undervalued relative to gold. If silver catches up, a move toward $50 per ounce is not just possible—it’s probable.

✔ Silver is the People’s Metal – Gold’s price surge makes it less accessible for many, but silver remains an affordable alternative for those looking to preserve their wealth.

What’s Next for Silver:

As markets awaken to silver’s undervaluation and increasing demand, its price trajectory is set for an explosive breakout. The time to act is before silver breaks $35, because once it does, momentum could carry it swiftly past $50 per ounce.

Next Week’s Key Events – What to Watch for Precious Metals

Monday, March 17

📌 U.S. Retail Sales (8:30 AM ET) – Weak numbers could boost gold and silver demand.

Tuesday, March 18

📌 Housing Starts & Building Permits (8:30 AM ET) – A downturn in housing could increase recession fears.

Wednesday, March 19

📌 FOMC Interest-Rate Decision (2:00 PM ET) – The biggest event of the week. If the Fed signals cuts, expect a gold rally.

Thursday, March 20

📌 Philadelphia Fed Manufacturing Survey (8:30 AM ET) – A weak report could support metals.

Friday, March 21

📌 No scheduled events – Market reaction to the Fed meeting will dominate the narrative.

Final Thoughts: The Path Forward for Gold and Silver

Gold at $3,000 is not the end—it’s the beginning. With inflation uncertainty, Fed policy shifts, and geopolitical turmoil brewing, metals are entering a new phase of strength.

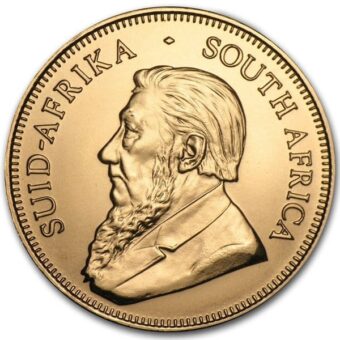

For those who haven’t secured their share of physical gold and silver, now is the time. At Brighton Enterprises, we provide premium U.S.-minted coins like the Gold American Eagle and Silver American Eagle, ensuring your wealth is stored in assets with intrinsic value and long-term potential.

📞 Call us today at 844-459-0042 or visit brightongold.com to secure your gold and silver before prices climb even higher.