WEEKLY MARKET RECAP: FROM RECORD HIGHS TO HEALTHY RESETS

Monday – April 21, 2025

Gold ignited with a $98 surge to $3,426.40, reaching a record high of $3,442.30 by midday. This momentum was fueled not by blind fear, but by increasing demand for stability as U.S.-China relations entered a new stage of tension. The phrase “bracing for cold war” echoed across media, and with equity markets dropping over 1,000 points, people sought financial gravity. Silver also rose, closing at $32.63.

Tuesday – April 22, 2025

Another milestone—gold hit $3,509.90 before pulling back to $3,409.00. The retreat wasn’t a retreat in confidence, but a natural instance of profit-taking. As Treasury officials offered reassuring language about trade negotiations, equities rebounded. Silver gained ground again, up to $33.045.

Wednesday – April 23, 2025

A healthy pullback sent gold down $121.20 to $3,297.60. Markets rallied on softened rhetoric out of Washington. But volatility doesn’t erase gold’s momentum—it reveals how responsive metals are to sentiment. Silver, continuing its quiet strength, moved up to $33.565.

Thursday – April 24, 2025

Buyers stepped back in, pushing gold to $3,342.70 with a $48.70 gain. This quick rebound illustrates strong undercurrents of demand. Even as U.S. stocks extended their rally, gold held firm. Silver dipped slightly to $33.48—more a breather than a reversal.

Friday – April 25, 2025

Gold cooled again, falling $41.60 to $3,307.00. Asian and European equities lifted on trade optimism. But geopolitical developments—like prospective U.S.-Russia talks and discussions around Iran—remain important subcurrents. Silver eased to $33.275, maintaining its upward channel.

THE BIGGER STORY: SENTIMENT IS DRIVING GOLD, BUT IT’S NOT SPECULATIVE

Talk of gold hitting $4,000 used to be dismissed as hyperbole. Now, it’s appearing in analyst forecasts from firms like UBS and Goldman Sachs. What’s changed? Confidence—not in gold, but in central banks and fiat structures—has eroded just enough to push market participants toward what’s historically dependable.

This isn’t gold becoming a bubble. This is gold reclaiming its role.

Gold ETF holdings, particularly SPDR Gold Shares (GLD), surpassed $100 billion for the first time. Meanwhile, the U.S. Dollar Index has broken below critical support levels. Bitcoin, once touted as digital gold, has risen alongside metals, but its volatility reminds us that nothing replaces the certainty of something you can hold.

The Mar-a-Lago Accord rumor—a purported strategy to weaken the dollar for trade leverage—may not be confirmed policy, but it does underscore the increasing politicization of currency. Markets don’t wait for confirmation. They react. And the reaction? A flight into hard assets.

GOLD: NOT THE BUBBLE. EQUITIES ARE.

There’s been no shortage of chatter suggesting gold is peaking. But if one asset class is exhibiting bubble-like behavior, it isn’t gold—it’s equities. U.S. stocks, priced near perfection, continue to defy gravity despite slowing earnings, stagnant productivity, and rising geopolitical risks.

Gold’s 27% year-to-date climb is robust, but it’s based on global shifts in central bank policy, fiscal uncertainty, and commodity-backed trade among BRICS nations. It is not speculative froth—it’s a reflection of deteriorating confidence in paper systems.

Contrast that with the stock market, which is rallying in pockets, even as cracks widen underneath. When the illusion fades, people will seek something real. Gold is already positioned.

GOLD: SILVER RATIO HITS 105—HISTORICALLY A SIGNAL, NOT A SIGNAL FLARE

The gold:silver ratio now sits at 105, a level not seen in three years. Traditionally, this kind of divergence appears during times of economic stress—but also right before silver begins to outperform.

Silver has lagged gold’s meteoric pace, but that lag sets up potential energy. With industrial demand—from solar energy to electronics—expected to rise sharply and a projected supply deficit of 117 million ounces in 2025, silver’s fundamentals are firm.

A mean reversion in the ratio to 75–80 could lift silver near $40 per ounce, even if gold remains flat. If gold rises in tandem, silver’s upside could be even more pronounced. This is not conjecture—it’s pattern recognition backed by physical constraints and rising demand.

HAS GOLD PEAKED? TD SECURITIES SAYS: NOT EVEN CLOSE

In markets, perception drives participation. But participation in gold is still far from crowded. TD Securities emphasizes that discretionary investors remain underexposed, in part due to the “cost of carry” and policy ambiguity. However, their analysis suggests $3,544 as a near-term target, with $4,000 in reach as demand normalizes.

Gold is up over 20% YTD, even with brief pullbacks. ETF holdings remain 20% below 2020 highs. Meanwhile, central banks—particularly in the East—are accumulating gold steadily to diversify away from dollar risk.

This quiet but persistent trend underscores gold’s enduring role—not just as a hedge, but as a counterbalance to a shifting world order where trust in Western monetary institutions is waning. It’s not panic—it’s prudence.

NEXT WEEK’S ECONOMIC CATALYSTS: WHAT TO WATCH

From Tuesday’s trade data to Friday’s jobs report, next week could shape market sentiment. Here’s what matters and why it could influence precious metals:

- Tuesday, April 29

- U.S. Trade Balance: A widening deficit could weigh on the dollar, strengthening gold.

- Consumer Confidence & JOLTS: Weak readings may support safe-haven flows.

- U.S. Trade Balance: A widening deficit could weigh on the dollar, strengthening gold.

- Wednesday, April 30

- ADP Jobs & Q2 GDP: If growth stumbles, metals may catch another bid.

- PCE Price Index: The Fed’s preferred inflation gauge—too high, and metals may stall. Too low, and rate cut hopes return.

- ADP Jobs & Q2 GDP: If growth stumbles, metals may catch another bid.

- Thursday, May 1

- Initial Jobless Claims: Rising claims support metals as labor softens.

- ISM Manufacturing & S&P PMI: Weak results could confirm slowdown concerns.

- Initial Jobless Claims: Rising claims support metals as labor softens.

- Friday, May 2

- Jobs Report: The week’s most critical data point. A miss could send metals higher.

- Factory Orders: Reflects business confidence and investment trends.

- Jobs Report: The week’s most critical data point. A miss could send metals higher.

The economic data doesn’t change the long-term trajectory for precious metals, but it will influence the short-term narrative. That’s why understanding these catalysts matters—not for reaction, but for preparation.

WHAT THIS MEANS FOR YOU: THE CASE FOR PHYSICAL METALS

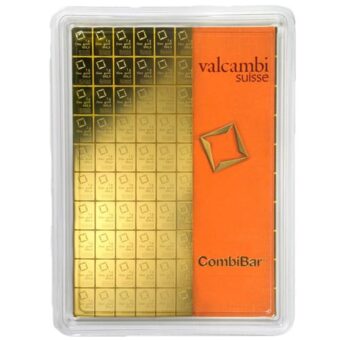

At Brighton Enterprises, we’ve never chased trends. We advocate for ownership—real, physical, tangible wealth in the form of U.S.-minted gold and silver coins. We don’t speculate; we secure.

With legal tender status, numismatic protections, and widespread recognition, American Eagle coins (gold and silver) continue to offer clarity in a foggy financial world. Their portability, liquidity, and tax advantages make them one of the smartest choices for anyone serious about protecting purchasing power.

And for those still debating silver’s role, let the numbers speak. Historical patterns, rising industrial use, and limited supply suggest silver is not just a secondary metal—it may be the most undervalued asset in the market today.

A FINAL THOUGHT FROM NATHANIEL CROSS

In 2008, people learned hard lessons about paper promises. Today, some of those same risks are resurfacing—masked under different acronyms and dressed in new language. But the fundamentals remain: when uncertainty rises, tangible assets outperform.

Gold at $4,000? That’s not a dream—it’s a trajectory rooted in value, not vanity. If you’re looking to shield your wealth from currency dilution, sovereign debt concerns, and central bank opacity, there’s one place where clarity still exists: in the weight of a coin you can hold.

Continue your education and protect your legacy with Brighton Enterprises.

Visit brightongold.com or call 844-459-0042 to speak with a precious metals specialist today.

We are not financial advisors. This content is for informational purposes only and should not be construed as financial advice. Please consult with a licensed professional for personalized guidance. This publication adheres to all SEC laws, rules, and guidelines.