Gold’s Shifting Role in the Global Economy

The recent pullback in gold prices should be viewed within the broader context of shifting economic expectations. As markets respond to evolving monetary policy, trade dynamics, and global growth concerns, gold continues to demonstrate its enduring relevance as a tangible store of value.

While some focus on whether the Federal Reserve will maintain or adjust interest rates, others are taking a closer look at how traditional financial instruments are performing in today’s environment. In that context, gold and silver offer a compelling contrast—free from counterparty risk and historically resilient during periods of transition.

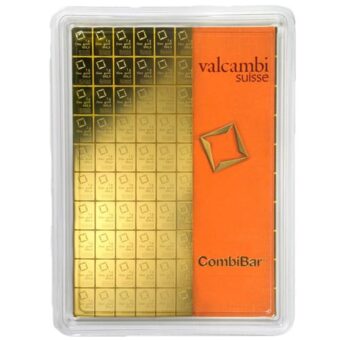

As market participants evaluate strategies for diversification and long-term stability, physical precious metals remain a practical option for those seeking to balance their portfolios with assets that are not tied to the performance of digital or paper-based instruments.

📈 Weekly Market Recap: Volatility Returns to the Gold Market

Monday – April 28, 2025

Gold launched the week with strong momentum. June contracts rose $46.84 to settle at $3,345.40. The rally was triggered by a sharp selloff in U.S. equities and a drop in the dollar index, both driven by weakening macroeconomic data and escalating global trade tensions. China formally called for the U.S. to rescind unilateral tariffs, while President Trump doubled down—promising even more aggressive levies. Meanwhile, the Texas manufacturing survey delivered a sharp miss, pointing to deepening regional weakness. Silver remained largely unchanged at $33.02. Though less reactive than gold, silver’s stability amid volatility underscored its dual role as both industrial metal and monetary hedge.

Key Insight: As fiat risk rises and trade relationships falter, gold quickly reasserts its role as the market’s compass—pointing true north in stormy conditions.

Tuesday – April 29, 2025

Gold prices dipped modestly, with June contracts falling $24.40 to $3,323.10. The decline came as broader risk sentiment improved slightly on rumors of diplomatic progress in U.S.–China trade talks. A stronger U.S. dollar and falling oil prices added downward pressure. Equities rose modestly, though analysts noted underlying concerns about corporate earnings momentum. Silver ticked up slightly, gaining $0.165 to $33.175. The metal’s resilience spoke to growing demand for real assets, even as temporary relief washed over risk markets.

Key Insight: While gold responds to macro shifts, silver’s continued strength highlights deeper demand for tangible, trusted stores of value in uncertain times.

Wednesday – April 30, 2025

Precious metals softened again, with gold dropping $15.20 to close at $3,318.60 and silver falling $0.67 to $32.605. The pressure came despite a trifecta of weak economic data: a sharp miss in ADP private payrolls, a 0.3% contraction in GDP for Q1, and ongoing declines in crude oil. Despite these signals of a slowing economy, markets appeared to price in the idea that Fed easing was not yet imminent. For gold and silver, this created a temporary lull—but with the backdrop of economic softness, it was more reprieve than reversal.

Key Insight: The market is misreading soft data as neutral. But for gold holders, every weak jobs number and GDP miss builds the case for long-term accumulation.

Thursday – May 1, 2025

Gold suffered its sharpest single-day drop of the week, tumbling $96.30 to $3,222.50. Silver followed suit, sliding $0.366 to $32.165. The move reflected a burst of profit-taking, a rebounding U.S. dollar, and a massive liquidation in crude oil, which dragged commodities across the board. Improved investor appetite for equities also played a role, as traders chased short-term gains. However, this type of “risk-on” euphoria has been repeatedly short-lived in recent quarters—and each retracement in gold has been followed by stronger rebounds.

Key Insight: Thursday’s sell-off was technical, not fundamental. For those who understand the cycle, these dips are accumulation opportunities—not red flags.

Friday – May 2, 2025

Gold rebounded strongly to close the week, reclaiming $46.30 to finish at $3,268.60. Silver added $0.311 to close at $32.495. The rebound followed a better-than-expected April jobs report, which showed 177,000 new non-farm payrolls—exceeding expectations of 133,000. However, the bullish headline was tempered by downward revisions to March and a steady unemployment rate at 4.2%. Beneath the surface, the data painted a picture of a labor market that is holding together—but not expanding robustly. Metals markets responded with strength, signaling that inflationary concerns and economic fragility are still top of mind.

Key Insight: Gold’s end-of-week rally shows that the safe-haven bid isn’t going anywhere. Market participants may flirt with optimism—but the long-term money continues to favor real assets.

📆 Next Week’s Economic Calendar: Volatility Is the New Normal

May 5 – May 9, 2025: Economic Events to Watch

- Monday, May 5

- 9:45 AM ET – S&P U.S. Services PMI (Final):

A strong reading could bolster confidence in economic growth, reinforcing the Fed’s case to keep rates elevated—bearish for gold. A weak print may ignite safe-haven flows into precious metals. - 10:00 AM ET – ISM Services Index (April):

The services sector remains a dominant component of the U.S. economy. A deceleration in activity could be seen as a precursor to recession, driving investors toward tangible assets.

- 9:45 AM ET – S&P U.S. Services PMI (Final):

- Tuesday, May 6

- 8:30 AM ET – U.S. Trade Deficit (March):

A widening deficit could weaken the dollar, thereby lifting gold and silver prices. A narrowing gap, by contrast, might dampen metals sentiment.

- 8:30 AM ET – U.S. Trade Deficit (March):

- Wednesday, May 7

- 2:00 PM ET – FOMC Meeting & Statement:

This is the main event. Any signal that the Fed is contemplating rate cuts would be explosive for gold. A hawkish tone may trigger short-term selling, but longer-term fundamentals remain supportive. - 3:00 PM ET – Consumer Credit (March):

Rising credit levels suggest consumer spending remains intact—bearish for gold. Declining or weak figures signal stress, increasing demand for stores of value.

- 2:00 PM ET – FOMC Meeting & Statement:

- Thursday, May 8

- 8:30 AM ET – Initial Jobless Claims (Week Ending May 3):

A spike in claims could point to labor market weakness, reinforcing expectations for monetary easing—bullish for metals. - 10:00 AM ET – Wholesale Inventories (March):

High inventory levels could imply slowing demand, raising recession fears. This would typically support safe-haven assets like gold and silver.

- 8:30 AM ET – Initial Jobless Claims (Week Ending May 3):

- Friday, May 9

- No major economic data released.

🛡️ Institutional Flight to Safety: BlackRock and Goldman Sachs Shift Toward Gold

BlackRock’s declaration that gold has outperformed both bonds and the dollar in 2025 is more than a market footnote—it’s a milestone. Vivek Paul, the firm’s Head of Portfolio Research, called gold a “global diversifier.” Translation? The largest money managers on Earth no longer trust the paper instruments they once peddled.

When the asset allocators at BlackRock pivot to physical gold, it signals a tectonic shift. Goldman Sachs is now projecting gold to reach $3,880 per ounce by year’s end. They’re not alone—entire economies are recalibrating away from fiat dependence.

This is no longer about speculation. This is about sovereignty.

🔱 John Paulson’s $5,000 Gold Call: Anchored in Geopolitical Reality

Paulson, best known for shorting the mortgage market ahead of the 2008 crisis, is now long gold—big time. His forecast of $5,000 per ounce by 2028 stems from data and action, not hype.

His Logic:

- Central Banks Are Buying, Not Selling: Especially in Asia and the BRICS+ alliance, where mistrust in the dollar system is high.

- Dollar Weaponization Backfired: The U.S. freezing Russia’s assets sent a message loud and clear—your dollar reserves can be taken at any time.

- Strategic Metal Projects in the U.S.: Paulson has poured capital into projects like Donlin Gold and Perpetua Resources—American-controlled, American-run.

He’s also backing domestic antimony production—vital for defense manufacturing. This isn’t just about profits. It’s about national strength and continuity.

📉 Trump at 100 Days: A Government Shrinking as Gold Surges

Trump’s aggressive fiscal tightening—through the Department of Government Efficiency (DOGE)—has trimmed $200 billion from the budget. But the underlying rot remains:

- Debt: $37 trillion

- Annual interest: ~$2 trillion

- Gold: Up 22% since January

The dollar, meanwhile, has slipped quietly. Central banks are not waiting for permission—they’re offloading Treasuries and rebalancing into gold.

This isn’t ideological. It’s strategic.

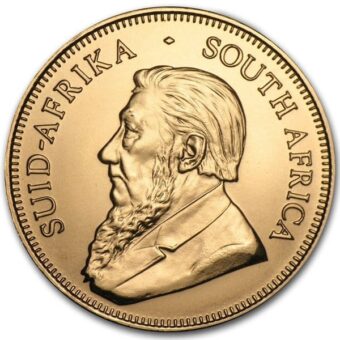

🪙 Remonetization: Why Gold Is More Than a Commodity

Gold is regaining its role as a financial anchor. This isn’t a blip. It’s a movement.

Central banks are loading up because they need reserves that can’t be frozen, devalued, or manipulated by outside actors. Gold, unlike any other asset, requires no counterparty. That alone gives it intrinsic power.

This trend is picking up momentum. With digital currencies looming, physical gold and silver are among the last bastions of true privacy and self-ownership.

💡 The Final Word: Return to Real Value Before It’s Priced Out

This isn’t just about inflation. It’s not just about central bank policy. It’s about the deeper reality that the fiat system has outlived its trust.

If you’re holding cash or digital paper, ask yourself: where will your wealth go when the dollar loses its privilege? What happens when the next wave of monetary tightening sends markets tumbling?

Gold and silver aren’t alternatives anymore. They are the foundation.

🛠️ Action Steps: Take Control While You Still Can

🔐 Reclaim financial sovereignty with physical metals that offer:

- Long-term protection

- Liquidity

- Privacy

- Legal and historical precedence

📞 Call Brighton Enterprises at 844-459-0042

🌐 Visit brightongold.com

Let us walk you through a custom allocation that fits your timeline, your goals, and your need for independence.

We are not financial advisors. This content is for informational purposes only and should not be construed as financial advice. Please consult with a licensed professional for personalized guidance. This publication adheres to all SEC laws, rules, and guidelines.