📉 Trillions Erased as Markets Reel from Tariff Shock

What began as routine policy speculation exploded into a full-blown financial disruption this week as markets reacted violently to new tariff measures introduced by the Trump administration. The S&P 500 plunged 4.8%, and in the span of just two trading sessions, more than $2 trillion in value evaporated from U.S. equity markets. In an era where most wealth exists digitally and can be reduced to nothing with a click, these events serve as a harsh reminder: paper markets are fragile—real assets are foundational.

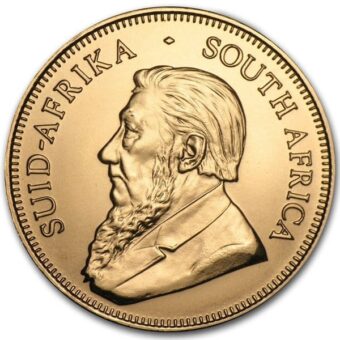

Initially, gold did exactly what it’s designed to do. As inflation fears mounted due to a hot PCE reading, the precious metal surged to an all-time high of $3,167.57 per ounce, affirming its status as a premier safe haven in times of macroeconomic distress. But the chaos that followed Trump’s sweeping tariff announcement triggered widespread liquidation, even among traditional safe-haven assets. By Friday, gold had dipped to $3,121.70, pulled down not by fundamental weakness, but by the urgent scramble to raise liquidity amid collapsing equities.

Silver mirrored gold’s trajectory, spiking early in the week before sliding under pressure from algorithmic selling and short-term profit-taking. Despite the turbulence, the underlying thesis for holding physical metals has never been stronger. In fact, this kind of temporary pullback sets the stage for renewed accumulation by market participants who understand the value of tangible stores of wealth.

📆 A Daily Journey Through the Week’s Market

Monday – March 31

Markets opened to a sense of apprehension. Gold futures reached a new peak at $3,162.00 an ounce, spurred by a confluence of inflation anxiety, geopolitical uncertainty, and anticipation of major policy moves from Washington. Global growth forecasts dimmed as trade tensions loomed. At the same time, Wall Street firms began recalibrating their outlook on gold. Goldman Sachs, never one to make such declarations lightly, projected that the yellow metal could ascend to $4,500 within the year—citing concerns over systemic debt, currency devaluation, and the erosion of trust in fiat systems.

Tuesday – April 1

The gold rally paused as some traders locked in profits. Equities experienced a modest recovery, but it lacked conviction. The sense of unease was still palpable across the trading floor. Despite the pullback, analysts noted that the core drivers of gold demand remained intact: a weakening dollar, broken supply chains, and the global shift toward economic nationalism. Gold’s short-term fluctuation did not erase its growing relevance in a financial system that’s increasingly out of sync with reality.

Wednesday – April 2

Gold climbed again, settling at $3,157.70, while silver rose to $34.625. The market braced for the long-anticipated tariff announcement. Bloomberg reported that $33 trillion in global trade was now at risk, potentially undermining everything from consumer goods to industrial supply lines. The economic dominoes were aligning for disruption. The U.S. tariff regime was expected to lift average trade levies by 28%, threatening American GDP growth and stoking the fires of imported inflation. The precious metals markets responded accordingly, bolstered by the growing likelihood of policy-induced recession.

Thursday – April 3

The sell-the-news phenomenon arrived. Following Trump’s official announcement, traders rushed to cash in gains. Gold dropped $33.70, and silver slid to $32.05, a four-week low. It was a classic liquidation event—not a change in fundamentals. Many institutional investors sought liquidity to cover margin calls or reallocate capital amidst heightened volatility. In these moments, gold becomes a source of funds, not a failed safe haven. What matters is what happens next: the reaccumulation phase, which often precedes significant upward moves.

Friday – April 4

Markets closed the week on a sour note. Gold fell further to $3,100.10, while silver dropped sharply to $30.955. The jobs report showed an impressive 228,000 non-farm payrolls added, beating expectations. But even strong labor data failed to offset the global sense of economic decoupling. Investors now faced the reality of higher input costs, shattered trade alliances, and rising inflation—all in a single week. This is precisely when physical assets begin to differentiate themselves from the digital noise.

🌎 Allies Look to America-Proof Their Economies

The response from America’s allies has been swift—and strategic. In boardrooms and parliaments around the world, a quiet revolution is taking shape: decoupling from the United States as a central economic anchor.

- The European Union, long considered a steadfast ally, is preparing a package of retaliatory measures to counter new U.S. tariffs. Ursula von der Leyen confirmed the EU would not remain idle in the face of American economic aggression.

- Canada, a close trading partner for over a century, is beginning to reevaluate the fundamentals of its relationship with Washington. Edmonton Chamber of Commerce President Doug Griffiths stated plainly: “We are looking at investments that make us less dependent on the U.S.”

- Germany, the fiscal conservative of Europe, is breaking tradition by increasing borrowing to shore up defense spending. This is more than military policy—it’s a pivot away from U.S.-led global stability.

Even in Asia, confidence in America is waning. Japan’s Prime Minister openly questioned the logic of applying uniform tariffs, while Australia’s leader condemned the moves as “unwarranted and unfriendly.”

What’s unfolding is not just economic retaliation—it’s a deliberate, long-term shift away from U.S. leadership. And in such times, what transcends national politics? Precious metals. Recognized everywhere. Trusted always.

🌐 Global Leaders Slam Trump’s Tariffs

Across the globe, world leaders issued one rebuke after another in response to Washington’s latest protectionist lurch. Here’s a summary of the geopolitical backlash:

- EU, Japan, and South Korea now face tariffs exceeding 20%

- Vietnam, a rising global supplier, was hit with a staggering 46% tariff

- Canada issued a retaliatory 25% tariff on U.S. auto exports that fail free-trade standards

- Mexico, the UK, Australia, and Sweden have called for de-escalation but are preparing responses

- Italy, while sympathetic to Trump ideologically, rejected the tariff strategy outright

Diplomatic ties are unraveling. More importantly, supply chains are breaking—a development with far-reaching consequences. With inflation already high and inventories stretched thin, tariffs risk compounding a fragile economic recovery. In this climate, metals are more than a hedge—they’re a fallback currency.

📊 Trump’s Tariff Formula: A No-Nuance Approach

Unlike previous trade strategies aimed at correcting specific imbalances or incentivizing fair trade, Trump’s new tariff regime operates with a mathematical bluntness. The rule? Calculate the bilateral trade deficit, divide by total imports from that country, halve the figure, and that becomes the tariff.

It’s not a policy—it’s a formula. And its rigidity leaves no room for negotiation.

- Vietnam’s 46% tariff is a direct result of this equation

- Norway, despite being a U.S. surplus partner, still received a 15% levy

- All partners face a 10% minimum, regardless of trade history

This approach undermines traditional diplomacy and economic nuance. It treats all deficits as inherently harmful and all surpluses as unfair advantages. The result? A framework that incentivizes economic fragmentation and discourages global cooperation.

This is not a path to sustainable trade. It’s a blueprint for economic nationalism, and while it may protect short-term interests, it accelerates the decline of trust in fiat currencies and centralized policy tools. Once again, it underscores the importance of holding value outside the system—like gold and silver.

🟡 Gold Faces Possible Dip, But Fundamentals Stay Strong

Even amid the current pullback, gold’s long-term story remains unchanged—and overwhelmingly bullish.

RBC Capital Markets has revised its gold forecast upward:

- $3,039/oz average in 2024

- $3,195/oz average in 2025

Their reasoning? The backdrop of deteriorating macroeconomic conditions and rising geopolitical risks. In their words, “Gold’s appeal is more durable in this environment.” They see downside risks as limited, with strong support near $3,050 and further down at $2,821.

Other factors supporting a bullish case include:

- A 47% chance of U.S. recession by year-end (Polymarket)

- Elevated consumer inflation expectations (Conference Board)

- Shifting Fed expectations, with future rate cuts likely if growth slows

Even if gold consolidates in the near term, the broader conditions are ripe for another upward leg. Those waiting on the sidelines for a perfect entry point might miss the real story: holding gold is not about timing—it’s about preparation.

🗓️ Economic Calendar Preview – April 7–11

Here’s what to watch this coming week, and how it may impact the precious metals markets:

Monday, April 7

- Consumer Credit (Feb)

Strong borrowing could reduce gold’s safe-haven appeal. Weak credit expansion supports the metals.

Wednesday, April 9

- Fed FOMC Minutes (March)

Dovish tones or rate-cut hints could boost metals. Hawkish signals might pressure them briefly.

Thursday, April 10

- CPI Inflation Report

A hot print could signal persistent inflation, bearish short-term for metals. A soft CPI could reinforce Fed pivot expectations, sending metals higher. - Jobless Claims

Strong labor data might curb metals. Higher claims support recession fears and boost gold/silver. - Fed’s Goolsbee Speaks

Watch for market-moving signals on policy outlook.

Friday, April 11

- PPI (March)

Elevated producer prices could weigh on metals short term. - Consumer Sentiment (Prelim – April)

Weak readings reflect caution and support metals. - Fed’s Williams Speaks

Policy signals from Fed officials remain key to metals trajectory.

🔚 Final Thoughts: Real Wealth is Physical

This week wasn’t just about numbers—it was about truth. We watched fiat wealth vanish. We saw alliances crack. And we were reminded that the system is only as stable as the confidence propping it up.

Gold didn’t fail. It did what it always does—it weathered the storm. It provided clarity when headlines confused. It preserved purchasing power as the digital economy faltered.

Now is the time to act.

Secure your wealth. Embrace independence. Hold what’s real.

👉 Visit brightongold.com or call 844-459-0042 to take the next step in preserving your wealth with physical gold and silver from Brighton Enterprises.

We are not financial advisors. This content is for informational purposes only and should not be construed as financial advice. Please consult with a licensed professional for personalized guidance. This publication adheres to all SEC laws, rules, and guidelines.