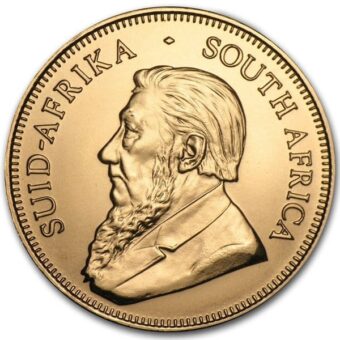

Friday Summary: Gold Shatters $2,800 Spot Record: Trade Wars and Fed Policy Uncertainty Fuel Safe-Haven Surge

Gold’s surge past $2,800/oz marks a historic milestone, cementing its role as a premier safe-haven asset amid escalating macroeconomic and geopolitical risks. This record-breaking rally reflects heightened investor anxiety over U.S. tariff policies—specifically the 25% levy on Mexican and Canadian imports announced by the Trump administration—which threaten to reignite trade wars and destabilize global markets. The breach of the $2,800 resistance level (previously a technical ceiling in late 2024) carries psychological significance, confirming gold’s bullish momentum and opening potential paths toward $3,000/oz.

Three primary drivers fueled this ascent:

- Monetary policy uncertainty: Despite the Federal Reserve holding rates steady, mixed signals about future cuts have kept real yields subdued while inflation persists at 2.9%. Gold thrives in this low-rate environment, as reduced opportunity costs make non-yielding assets more attractive.

- Geopolitical tensions: Escalating conflicts in the Middle East, U.S.-China trade friction, and fears of Eastern European military conflicts have amplified safe-haven demand.

- Structural market shifts: Central banks—particularly China—are aggressively diversifying reserves into gold to hedge against dollar volatility, with reported purchases tightening physical supply.

Technical breakthroughs and speculative trading further accelerated the rally. Gold shattered its October 2024 peak of $2,790 after consolidating for months, triggering algorithmic buying and ETF inflows. Meanwhile, traders anticipate Fed rate cuts in 2025 (priced at 40% probability for May), which Goldman Sachs predicts could propel prices to $3,380 if historical patterns hold. While short-term pullbacks are possible, the convergence of inflationary pressures, currency debasement fears, and geopolitical instability suggests gold’s bull market remains in its early stages.

Weekly Precious Metals Recap: A Look at the Numbers

Monday, 1.27.25 – Gold declined 0.6% to $2,755.80 per ounce, and silver dropped 1.1% to $30.26 per ounce. The stronger U.S. dollar played a role in this movement, as currency strength typically puts downward pressure on metals. Investors were also looking ahead to the Federal Reserve’s upcoming meeting for potential guidance on interest rate policy.

Tuesday, 1.28.25 – Gold stabilized at $2,739.28 per ounce, while silver experienced a slight dip of 0.8%, closing at $29.97 per ounce. Market focus remained on developments in China’s DeepSeek AI model and the Federal Reserve’s anticipated decision, with traders broadly expecting rates to remain unchanged.

Wednesday, 1.29.25 – Gold edged lower by 0.4% to $2,753.86 per ounce, mirroring silver’s minor decline. Notably, 24-carat gold in major Indian cities surpassed ₹80,000, reflecting global price movements. A combination of a stronger dollar and rising Treasury yields contributed to the slight decline, following the Federal Reserve’s decision to keep interest rates steady.

Thursday, 1.30.25 – Precious metals saw an uptick, with gold gaining 0.63% to $2,770.51 per ounce, while silver increased 1.02% to $31.03 per ounce. These movements followed the Federal Reserve’s announcement that interest rates would remain within the 4.25%-4.50% range, influencing investor sentiment in favor of metals.

Friday, 1.31.25 – Gold held steady after reaching new highs earlier in the week, with April gold futures touching $2,859.50 overnight. Market participants continued to watch trade policy developments, particularly proposed tariffs between the U.S., Canada, and Mexico. Reports also indicated increased interest in physical gold, with Bank of England deliveries experiencing delays and COMEX inventories expanding, contributing to shifts in the London-New York bullion spread.

The Federal Reserve Holds Rates, Monitors Inflation Trends

At its latest meeting, the Federal Reserve opted to maintain its benchmark interest rate within the 4.25%-4.50% range, pausing its rate-cutting cycle after three consecutive reductions since September 2024. While the central bank acknowledged continued economic strength, it removed prior language suggesting inflation was making clear progress toward its 2% target, signaling a more data-dependent approach moving forward.

Key Takeaways from the Fed Decision:

- Rates remain unchanged – After cutting rates by a full percentage point in 2024, the Fed is now pausing to assess economic conditions before making further moves.

- Inflation remains a focal point – The Fed’s preferred inflation measure rose to 2.4% in November, while core inflation stood at 2.8%. This suggests that price stability goals may take longer to achieve.

- Political and market reactions – While some policymakers advocate for rate cuts, the Fed remains cautious, prioritizing economic data over external pressures. Equity markets adjusted expectations accordingly, leading to a decline in stock indices following the decision.

Investor Outlook:

- Rate cut timing remains uncertain – Markets currently anticipate the next rate cut in June, with a 61% probability of two reductions by the end of 2025.

- Economic growth remains steady – GDP for Q4 2024 is tracking at 2.3%, showing resilience despite slight downward revisions from earlier estimates.

- Precious metals implications – If interest rate cuts are delayed, gold and silver may continue to find support, as lower yields make non-yielding assets more attractive.

Looking Ahead:

The Federal Reserve is expected to hold rates until clear signs of either slower inflation or economic weakness emerge. Market participants will continue monitoring future statements from Fed Chair Jerome Powell, as well as any developments that could influence rate policy in the months ahead.

Gold’s Performance and Future Projections

Gold prices reached new highs this week, with analysts now considering a $3,000 per ounce target as a potential milestone. Silver also demonstrated strong momentum, rising 4% to surpass $32 per ounce.

Key Drivers Behind Gold’s Strength:

- Record highs in futures markets – February gold contracts traded at $2,849.40 per ounce, while silver climbed to $32.475 per ounce.

- Analyst expectations – Some market strategists, including Michele Schneider of MarketGauge, suggest that gold breaking above $2,800 could provide a foundation for further gains.

- Federal Reserve policy influence – The Fed’s decision to keep rates steady contributed to gold’s strength, reinforcing its role as a hedge against uncertainty.

- Broader market sentiment – Analysts also point to ongoing global economic shifts and policy decisions as additional factors supporting gold’s upward trajectory.

Silver’s Breakout Potential:

- Technical momentum – Analysts at TD Securities highlight silver’s move beyond a long-term wedge pattern, suggesting that further gains may be possible.

- Investment demand – Silver exchange-traded funds (ETFs) have not yet seen major inflows, which could leave room for additional upside if investor interest picks up.

Outlook for Gold and Silver:

With gold trading at $2,777.40 per ounce and reaching an intraday high of $2,794.80, the market remains in a strong position. Analysts expect continued volatility as inflation data, central bank policies, and economic indicators shape price movements.

Trump’s Trade Tariffs and Their Potential Impact on Gold

President Trump’s proposed tariffs on Canada, Mexico, and China have raised questions about their potential inflationary effects and broader economic consequences. If implemented, these tariffs could lead to higher consumer prices, increased production costs, and shifting trade relationships, all of which may have implications for gold and silver markets. Analysts predict that these policies could push U.S. inflation from 2.9% to 3.7% by the end of 2025.

Why It Matters:

✅ Deutsche Bank forecasts higher inflation – Tariffs of 25% on Canada/Mexico and 10% on Chinese importscould raise the cost of goods for American consumers, as businesses pass along higher expenses to buyers. This inflationary pressure historically supports higher gold prices, as investors look for assets that retain purchasing power.

✅ Goldman Sachs sees higher gold demand – Rising inflation expectations tend to drive increased demand for gold, as it is widely seen as a hedge against currency devaluation and economic uncertainty. If inflation accelerates beyond expectations, gold could strengthen further as a wealth preservation tool.

✅ The U.S. dollar could weaken – Tariffs, combined with fiscal stimulus measures, may contribute to a growing national debt, potentially leading to a weaker dollar. Since gold is priced in dollars, a declining dollar typically boosts gold’s value, making it more attractive to both domestic and international investors.

✅ Potential supply chain disruptions – Tariffs could alter global supply chains, impacting mining and manufacturing costs for silver and industrial metals. Silver, which has significant use in electronics and solar technology, may see increased volatility if supply constraints emerge.

Looking Ahead:

If trade tensions escalate and tariffs take effect on February 1, inflation concerns could accelerate the rally in gold and silver. Investors will closely monitor the Federal Reserve’s response to inflationary pressures, as any delay in rate cuts could further support higher gold prices.

With shifting economic policies on the horizon, diversifying with physical gold and silver could be a strategic move for long-term wealth preservation.

Upcoming Economic Events That Could Impact Precious Metals

Monday, Feb. 3:

- S&P Final U.S. Manufacturing PMI (Jan.) – A lower reading could support gold and silver by signaling economic slowdown.

Tuesday, Feb. 4:

- JOLTS Report (Dec.) – Job openings data will provide insight into labor market strength, which could influence Fed policy expectations.

Wednesday, Feb. 5:

- ADP Employment Report (Jan.) – Private-sector job growth trends may impact market sentiment regarding future rate cuts.

Thursday, Feb. 6:

- Initial Jobless Claims (Feb. 1) – Weekly unemployment data can serve as an early indicator of labor market conditions.

Friday, Feb. 7:

- Employment Situation Summary (Jan.) – The official jobs report is one of the most influential data points for market expectations.

- Consumer Sentiment (Prelim) (Jan.) – Higher confidence levels could reduce demand for gold as a safe-haven asset.

Final Thoughts: Positioning for the Road Ahead

With economic policy in focus and inflation still a key variable, gold and silver remain central to many investment strategies. Whether as a hedge against uncertainty, a store of value, or a component of diversification, precious metals continue to attract attention.

For those interested in securing their wealth with physical gold and silver, Brighton Enterprises offers a range of options to suit your portfolio needs.

📞 Call us today at 844-459-0042

💻 Visit us at brightongold.com

We are not financial advisors. This content is for informational purposes only. Please consult a licensed professional before making investment decisions.