This week wasn’t just another market cycle—it was a seismic shift in the ongoing battle between real assets and the illusions of digital finance. Silver vaulted to a 13-year high, gold steadied near peak levels, and global tensions sparked fresh demand for something real. As central planners continue their dance of denial, those with eyes to see understand the implications. We’re living in a world where trust in paper is fading fast, and tangible wealth is reclaiming its rightful place.

A Market in Motion: The Week in Precious Metals

Monday – June 2, 2025

Gold and silver took flight as geopolitical friction lit the fuse on safe-haven buying. With U.S.-China trade tensions reigniting and President Trump vowing aggressive new tariffs, the metals surged. August gold climbed a staggering $86.30 to reach $3,401.90—its highest level in three weeks. Silver didn’t lag behind, leaping $1.566 to $34.59 and notching a two-month high. A weakening dollar, elevated oil prices, and growing economic unease compounded the momentum. Jamie Dimon’s stark warning about a looming bond market crack added fuel to the fire. His concern? That America’s swelling national debt is becoming an unmanageable anchor—one that could snap the very foundation of the financial system.

Tuesday – June 3, 2025

After Monday’s explosive move, the metals market caught its breath. Gold edged down by $24.80 to $3,372.40, while silver gave up $0.129, settling at $34.565. But this wasn’t capitulation—it was tactical. Market participants took profits off the table, yet demand remained firm beneath the surface. Despite equity markets rallying on artificial optimism, the underlying anxiety about global trade and monetary integrity lingered, preserving gold and silver’s defensive allure.

Wednesday – June 4, 2025

As economic indicators began to wobble, gold resumed its upward march. The ADP payroll report shocked analysts with just 37,000 new jobs—well below expectations—and ISM services data came in soft. The response? A retreat in Treasury yields and a slump in the dollar, both of which fueled safe-haven demand. August gold jumped $25.40 to $3,402.50, while silver eked out modest gains, rising to $34.66. Trump’s repeated calls for rate cuts—amid signs of economic fragility—further stirred the debate over the Fed’s next move. The message from the metals? People aren’t waiting around to see how this plays out.

Thursday – June 5, 2025

Gold cooled slightly on profit-taking, dropping $22.60 to $3,376.20. But silver? It exploded to $35.75—a level not seen in over a decade. That breakout was no accident. With traders bracing for Friday’s jobs report, many chose to reposition into silver as uncertainty mounted. The markets are sending a clear message: gold is a pillar, but silver is awakening as both a monetary and industrial force in an era of de-dollarization and reindustrialization.

Friday – June 6, 2025

The May jobs report arrived without drama—139,000 new jobs versus an expected 125,000—but gold barely budged, slipping just $4.00 to close at $3,370.00. Silver, however, roared again, hitting $36.23. Even with unemployment steady at 4.2%, wage growth and inflationary pressures suggest the Fed will remain in “pause” mode for now. This indecision continues to support gold’s consolidation and silver’s accelerating run.

Gold Prices Steady Amid ‘Goldilocks’ Jobs Report

Gold’s resilience this week confirms one thing: markets are pricing in uncertainty, not optimism. With August futures holding steady near $3,350 and spot gold at $3,357.59, the metal remains anchored by concerns over sticky inflation, stagnant real wage growth, and a Fed trapped between recession risk and inflation expectations.

- Nonfarm Payrolls: +139,000 (vs. +126,000 expected)

- Unemployment Rate: Unchanged at 4.2%

- Wage Growth: +0.4% month-over-month; +3.9% year-over-year

Revisions to March and April’s numbers—downward by 95,000 jobs—reveal a soft underbelly in the labor market. It’s a classic “Goldilocks” scenario: not strong enough to push for rate hikes, but not weak enough to demand immediate easing. For physical metal holders, this backdrop is ideal—volatility without clarity, and opportunity without competition from rising real yields.

ETF Outflows Signal Short-Term Rotation, Not a Reversal

Gold-backed ETFs posted their first net outflows in five months, shedding 19.1 tonnes worth $1.83 billion. While this might appear bearish on the surface, it reflects shifting short-term risk sentiment rather than a true loss of confidence in gold.

- North America: 15.6 tonnes outflow ($1.5B)

- Asia: 4.8 tonnes outflow ($489M) — first since November 2024

- Europe: 1.6 tonnes inflow ($224M), led by French funds

This rotation coincides with temporary market optimism following improved U.S.-China trade signals and tech-driven equity gains. But the World Gold Council remains clear: inflation, debt, and geopolitical dysfunction remain powerful tailwinds for gold. Europe’s continued accumulation reinforces the global divergence: while some wait, others prepare.

Why Analysts See $4,000 Gold on the Horizon

Forecasts are growing bolder. Morgan Stanley sees $3,500 by Q3. Others are quietly whispering $4,000—not as a fantasy, but as a reasonable projection given current macro dynamics.

- Dollar Index: Down 9% year-to-date; now hovering near 99

- Central Bank Buying: Sustained levels of accumulation by BRICS nations

- Mining Sector: Outperforming tech stocks in year-to-date gains

- Gold’s Inverse Correlation with USD: Near historic extremes—seen only 7 times since 1990

The message? A falling dollar, persistent geopolitical friction, and a global move away from U.S. hegemony are putting fire under the gold price. This isn’t hype—it’s history repeating itself.

Silver’s Awakening: A Metal With Dual Power

The spotlight may have been on gold, but silver made its presence known with brute force. At $36.23, silver is not only reclaiming its industrial relevance—it’s emerging as a monetary hedge for a world skeptical of fiat stability.

- Key Breakout: $34 level surpassed with volume and momentum

- Next Target: $40, as per MarketGauge’s Michele Schneider

- Gold-to-Silver Ratio: Tumbled from a peak of 107 to the low 90s

The ratio collapse mirrors 2020, when silver outpaced gold by over 50%. And with silver’s industrial demand anchored in the energy transition and tech production, any monetary rotation toward precious metals only adds more fuel to the fire.

Fed’s Beige Book: Trouble Beneath the Surface

The June Beige Book didn’t sugarcoat the situation:

- Growth: Contracting in several districts

- Employment: Flat in the majority of regions

- Tariffs: Mentioned 122 times, vs. 107 in April

- Inflation: Rising moderately, with expectations for more

Businesses are preparing to pass costs onto consumers, and labor market softness hints at an economy running out of steam. Tariffs are distorting input prices, and the Fed’s policy toolkit appears increasingly ineffective. This is an environment where real assets shine—because policy can’t print trust.

Next Week’s Economic Calendar: What Market Participants Need to Watch

Monday, June 9

- No major reports scheduled

Tuesday, June 10

- No major reports scheduled

Wednesday, June 11

- 8:30 AM ET – Consumer Price Index (CPI) – May

A 0.2% expected rise signals mild inflation. A surprise in either direction could shift Fed rate expectations and influence metals.

Thursday, June 12

- 8:30 AM ET – Initial Jobless Claims (Week Ending June 7)

Early signal of labor market health. Rising claims could reinforce safe-haven demand. - 8:30 AM ET – Producer Price Index (PPI) – May

Expected to show a -0.5% drop in wholesale inflation. Could suggest easing upstream pricing pressures—favorable for gold and silver.

Friday, June 13

- 10:00 AM ET – University of Michigan Consumer Sentiment (Preliminary) – June

Forecast: 52.2. Low sentiment typically coincides with rising demand for tangible assets like metals.

How These Events Could Move Precious Metals

CPI (June 11): If inflation remains tame, metals may stabilize. A hotter-than-expected print could revive gold’s rally as real yields fall.

Initial Jobless Claims (June 12): Unexpectedly high claims may reflect a deteriorating labor market—bullish for safe-haven buying.

PPI (June 12): If confirmed negative, it would strengthen the disinflation narrative, reinforcing the case for precious metals as the Fed hesitates.

Consumer Sentiment (June 13): Continued pessimism can lead to defensive repositioning, boosting demand for physical assets.

Conclusion: Why This Moment Demands Action

We are not just in a metals market rally—we’re in a global realignment of value. While Wall Street debates rate cuts and digital tokenization, those grounded in real wealth are making deliberate moves. Gold is holding strong. Silver is breaking out. And central banks are doing something very few are talking about: they’re stacking.

You should be too.

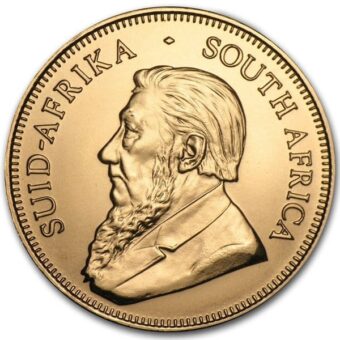

Take the First Step with Brighton Enterprises

At Brighton, we believe in financial sovereignty, not dependence on collapsing systems. Explore our expertly curated selection of gold and silver coins—especially American-minted pieces with historical and numismatic advantages. Learn how to store your wealth securely and responsibly. And take ownership of your financial destiny today.

📞 Call us at 844-459-0042

🌐 Visit brightongold.com

We are not financial advisors. This content is for informational purposes only and should not be construed as financial advice. Please consult with a licensed professional for personalized guidance. This publication adheres to all SEC laws, rules, and guidelines.