Introduction

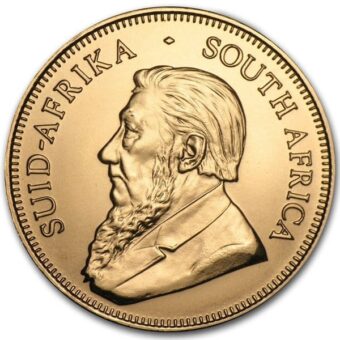

The global capital map is shifting—fast. Once seen as the safest bet in finance, U.S. debt is now being quietly abandoned by major players. From foreign central banks to institutional money, the trend is clear: fewer bonds, more gold. Confidence in America’s fiscal trajectory is fading, and market participants are looking elsewhere for stability.

This newsletter unpacks the big picture. We’ll cover the key market developments of the week, break down what’s behind the bond exodus, and explain how countries like China and Japan are redrawing the rules—with gold increasingly at the center.

Weekly Market Recap (May 19–23, 2025)

Monday: Downgrade Sparks Gold Spike

Gold soared to $3,233.80 midday as Moody’s downgraded U.S. government debt, citing unsustainable fiscal policies and ballooning deficits. Silver ticked up to $32.54. Treasury Secretary Bessent’s warning about looming tariffs without trade negotiation progress further rattled markets.

Tuesday: Safe-Haven Surge Intensifies

Gold pushed to $3,281.70 and silver to $33.025 on persistent safe-haven demand. The downgrade dominated headlines, and while market participants braced for a Fed pause, rising inflation fears suggested volatility ahead.

Wednesday: Geopolitics and Chinese Gold Appetite

Gold climbed to $3,310.70 as fears of conflict between Israel and Iran escalated. Simultaneously, China’s 73% spike in gold imports highlighted its accelerating move to de-dollarize and build a bullion-based reserve system.

Thursday: Bond Market Breaks Down

Gold dipped modestly from profit-taking but held firm as a disastrous 20-year Treasury auction sent the 30-year yield to 5%+. Global bond markets convulsed, with Japanese yields also reaching multi-decade highs. Wall Street panicked over a Trump-backed spending bill projected to add $3.8 trillion to the deficit.

Friday: Trump Tariff Threats Ignite End-of-Week Rally

Gold surged to $3,340.90 as market participants sought shelter ahead of the holiday weekend. President Trump’s threats to tax iPhones and EU goods added political risk to an already fraught economic outlook.

Economic Calendar Preview: May 26–30, 2025

- Tuesday, May 27:

S&P CoreLogic Case-Shiller Index & Consumer Confidence – Weak data could bolster gold as fears of recession mount. - Wednesday, May 28:

FOMC Minutes – A dovish tilt could extend the metals rally; hawkish surprises may briefly cool momentum. - Thursday, May 29:

Jobless Claims, Q1 GDP Revision & Pending Home Sales – Weakness here would increase safe-haven flows into gold and silver. - Friday, May 30:

PCE Index & Consumer Sentiment – A hotter-than-expected PCE would elevate yields and test gold’s resilience short-term, while soft numbers would reinforce bullish fundamentals.

The Bull Market for Gold and Silver: Just Beginning

Gold at $3,300 is not a peak—it’s a launchpad. According to veteran analyst Jordan Roy-Byrne, a confirmed breakout from a 13-year cup-and-handle pattern sets the stage for a massive secular bull market not seen since the post-Bretton Woods era or the stagflationary 1970s. His projections are not hype. They’re historically and technically grounded: gold at $4,500 and silver at $100 within 12 to 15 months.

We’re in the early innings of a breakout phase driven by collapsing faith in fiat institutions, not just inflation. Roy-Byrne notes how deteriorating credit conditions, declining bond market performance, and increasing central bank demand form a trifecta of upward pressure on metals. Gold is already outperforming the S&P 500 and the classic 60/40 portfolio—a telltale sign that Wall Street’s faith in paper assets is eroding.

Silver, often the laggard, is now coiling for an explosive move. Once it breaks the $35–$37 resistance band, the parabolic rise could be historic. And let’s not forget miners: undervalued and ignored for years, they could deliver leverage of 3x to 5x once this rally ignites. This isn’t a top—it’s a new beginning.

Japan’s Retreat: When Our Biggest Buyer Steps Back

Japan, once America’s most reliable creditor, is pivoting away from U.S. Treasuries. With $1.13 trillion in holdings, Japan’s institutional investors—especially life insurers—are quietly becoming net sellers. Why? Currency hedging costs have exploded, domestic yields are rising, and the Bank of Japan is exiting its ultra-loose stance.

This strategic pullback isn’t just a portfolio reallocation. It’s a wake-up call. For decades, Japan’s bid for U.S. debt stabilized markets. Now, their departure signals that even close allies are questioning America’s fiscal discipline. Fewer buyers mean higher borrowing costs, and higher borrowing costs mean deeper deficits. It’s a feedback loop with dangerous implications.

The global message is clear: no buyer is guaranteed. And in the vacuum, only real assets—gold and silver—stand as enduring stores of value.

China’s Gold Rush: Strategic De-Dollarization in Motion

China’s April gold imports soared to 127.5 metric tons—a 73% leap from March. This isn’t seasonal buying. This is statecraft. Beijing is turning bullion into a weapon of economic sovereignty, insulating itself from the dollar-centric system by building an alternative anchored in the yuan and hard metal.

Retail investors, insurers, and the People’s Bank of China are aligned in purpose: amass gold as a counterbalance to mounting U.S. liabilities. Shanghai’s gold trading volume hit record highs in tandem, showing conviction, not speculation.

This is about more than price. It’s about leverage. With every ton of gold, China chips away at the dollar’s supremacy. And for the global metals market, this means persistent, institutional demand that won’t vanish with a single rate hike or data point. Gold is no longer just a store of value—it’s the foundation of a new financial order.

Impact on the Precious Metals Market

Consumer Confidence & Sentiment (May 27, 30):

High confidence levels could temporarily weigh on gold by signaling resilient spending and economic optimism. But if consumer sentiment softens, it may boost safe-haven buying, especially as markets brace for prolonged fiscal uncertainty.

FOMC Minutes (May 28):

Any hawkish undertones—suggestions of further tightening or concern about inflation—could stall the rally in gold. On the flip side, dovish language or emphasis on data-dependence would likely accelerate metals momentum.

Initial Jobless Claims (May 29):

Rising claims would signal a softening labor market—typically bullish for gold, as it increases the likelihood of Fed support. Conversely, lower claims could signal economic strength and possibly pressure gold if rate hike fears resurface.

GDP Revision – Q1 (May 29):

A downward revision would reinforce concerns about economic slowdown, supporting demand for gold and silver. Stronger growth data could weigh on metals if markets interpret it as justification for tighter policy.

Pending Home Sales (May 29):

Weak housing activity may indicate consumer strain and broader economic cooling—positive for precious metals. A surprise uptick, however, could add to optimism around the economy and reduce short-term safe-haven appeal.

PCE Inflation Index (May 30):

The Fed’s preferred inflation gauge could be the market’s biggest mover. A hotter-than-expected print may push yields higher and dampen gold temporarily. A cooler number would likely ignite a rally on hopes of near-term Fed easing.

Final Word: Don’t Wait to React—Act Now

The U.S. fiscal house is burning quietly. Elites know it. Foreign governments know it. And increasingly, market participants know it. The question is: will you wait for the mainstream to tell you it’s time to buy gold—or will you act while the exits are still uncrowded?

At Brighton Enterprises, we’re not here to scare you—we’re here to empower you. Real assets. Real wealth. Real independence.

Call us at 844-459-0042 or visit brightongold.com to start protecting your future today.

We are not financial advisors. This content is for informational purposes only and should not be construed as financial advice. Please consult with a licensed professional for personalized guidance. This publication adheres to all SEC laws, rules, and guidelines.