The Power of Tangible Wealth in an Age of Uncertainty

In these volatile times, the markets may seem to dance to the erratic tune of digital digits and political maneuvering, but there’s one pillar of stability that stands firm: physical gold and silver. As the past week’s market movements show, owning real, tangible wealth is no longer a luxury—it’s a necessity for safeguarding your family’s future. Let’s dig in and uncover what this week’s economic news really means for those of us who refuse to trust our livelihoods to fleeting promises and ephemeral financial systems.

Weekly Market Recap: A Dance of Hope and Uncertainty

Monday, 5.26.25 – Memorial Day

Markets were closed in solemn honor of those who gave everything for freedom. A powerful reminder that real security—whether in liberty or in wealth—demands courage and vigilance.

Tuesday, 5.27.25 – Profit-Taking Amid Tariff Delays

Tuesday’s session saw gold down to $3,292.00 and silver to $33.21. Traders locked in profits as risk appetite improved after President Trump delayed EU tariffs to July 9. But while markets cheered, prudent participants knew this delay was merely a temporary reprieve, not a permanent fix.

Wednesday, 5.28.25 – Calm Before the Storm

Gold hovered at $3,297.20 and silver at $33.19 as traders braced for the Fed’s minutes release. Stock indexes dipped modestly after Tuesday’s surge, reflecting a market that’s never sure how to price tomorrow’s uncertainties.

Thursday, 5.29.25 – Gold Finds Its Footing Again

Gold prices surged to $3,353.80 as the dollar softened and Treasury yields slipped. A federal court’s ruling against Trump’s tariffs—and the administration’s immediate appeal—underscored just how fragile global trade relationships have become. Even as stock indexes gave back gains, the safe haven of gold rose to the occasion.

Friday, 5.30.25 – A Sobering Reality Check

Early Friday trading saw gold easing back to $3,322.00 and silver to $33.30. President Trump’s vow to be tougher on China, coupled with an inflation report that met expectations, left markets on edge. While the digital world watched every tweet, physical gold and silver holders rested easy, knowing real assets don’t tremble at the latest headline.

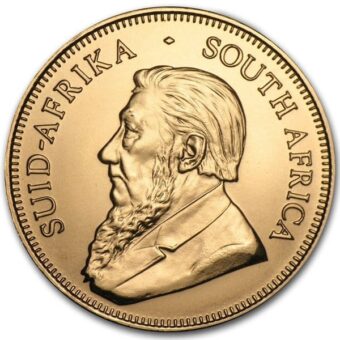

The Big Picture: Gold’s Resilience in the Face of Steady Inflation

Gold’s ability to hold the line above $3,300/oz despite modest inflation data highlights what we’ve always known: real wealth is about more than charts and forecasts. The Core PCE index—the Fed’s favored measure—rose 0.1% in April, and 12-month core inflation slowed to 2.5%. Yet through it all, gold’s steady hand reminds us that true wealth isn’t created in spreadsheets. It’s held in the weight of a coin, the glint of a bar, and the reassurance of physical ownership.

By the Numbers:

- April core PCE index: +0.1%

- 12-month core inflation: +2.5%

- Spot gold: $3,301/oz

Why It Matters for Market Participants

While the financial elite debate decimal points and central bank speeches, real Americans know that physical gold and silver stand outside the game. These metals aren’t beholden to policy shifts or political posturing. They’re the bedrock of a financial foundation that can’t be digitized or erased.

Consumer Confidence: A Temporary Rebound or a Mirage?

A 12-point surge in consumer confidence in May offers a glimmer of hope. But let’s not kid ourselves—factory orders plunged 6% in April, after an 8% spike in March. The pendulum swings wildly when policies are driven by political calculations instead of economic fundamentals. Physical gold and silver provide the ballast you need when the political winds blow in every direction.

Fed Minutes: Steady Hands or Shaky Ground?

The Fed’s May meeting minutes struck a tone of cautious confidence: solid labor market, modest growth, but real concerns about trade disruptions and a weakening dollar.

- Federal funds target rate: 4.25% to 4.5%

- Dollar index decline: over 2%

- Treasury yields: Short-term down ~20 bps; long-term up

Yet behind the official statements lies an uneasy truth: the Fed’s balancing act grows ever more precarious. For those of us seeking safety, physical gold and silver remain the best insurance policy money can buy.

Trump’s EU Tariff Extension: A Pause, Not a Peace

Trump’s decision to extend the EU tariff deadline to July 9 was greeted with relief by markets. But let’s be honest: it’s a pause in the hostilities, not an end. The threat of a 50% tariff on EU goods still looms, and the EU’s promise of €95 billion in retaliation is a warning shot across the bow. When political brinkmanship replaces genuine economic cooperation, there’s only one safe harbor: real, physical assets that can’t be weaponized by trade wars.

BoA’s $4,000 Gold Forecast: The Calm Before the Storm

Francisco Blanch of Bank of America says gold will hit $4,000 and silver $40 by year-end, driven by global turmoil and policy confusion. This isn’t just a wild guess—it’s a sober acknowledgment that in times of uncertainty, tangible assets rise above speculation. When the dust settles, the people holding real gold and silver will be the ones with real power.

China’s Gold Import Surge: A Lesson in True Wealth

China’s gold imports via Hong Kong nearly tripled in April, hitting an 11-month high of 127.5 metric tons. As Beijing stockpiles real assets, it’s a clear signal: the world’s second-largest economy is betting on tangible wealth, not digital promises. If they see the writing on the wall, shouldn’t you?

The Historical Weight of Precious Metals: 5,000 Years of Trust

It’s no accident that physical gold and silver have outlasted every empire, currency, and political regime. From the ancient kingdoms of Mesopotamia to the bustling mints of modern America, these metals have always been more than money—they’re the story of human civilization itself. In an age of intangible digits and digital illusions, owning physical gold and silver is about reconnecting with that timeless story of security and independence.

Next Week’s Economic Calendar: The Data That Will Shape the Week

Here’s what to watch as the markets brace for a fresh batch of insights—and what it means for your real, physical wealth.

Monday, June 2:

- S&P Final U.S. Manufacturing PMI – May: Gauges manufacturing activity. A strong number suggests economic expansion (potentially bearish for gold), while a weak number could reinforce gold’s safe-haven status.

- ISM Manufacturing – May: Another critical look at the manufacturing sector, with the same implications for the real economy.

- Dallas Fed President Lorie Logan Speech: As a voting Fed official, any hint of caution or dovishness could ignite fresh demand for gold.

Tuesday, June 3:

- JOLTS Report – April: Job openings data that shows labor market strength. High job openings might stoke inflation fears, but a downturn would highlight why gold remains the ultimate backstop.

Wednesday, June 4:

- ADP Employment – May: A preview of Friday’s official jobs report, this private payroll data sets the tone for labor market health.

- S&P Final U.S. Services PMI – May: A read on the critical services sector, with implications for broader economic health.

- ISM Services – May: A key barometer for the economy’s largest sector. Softness here could send gold and silver prices soaring.

Thursday, June 5:

- Initial Jobless Claims – Week Ending May 31: A leading indicator of labor market health. Rising claims? Bullish for gold. Falling claims? Bearish in the short term.

- U.S. Trade Deficit – April: A widening deficit could weaken the dollar, supporting gold. A narrower deficit may give the dollar a temporary lift.

Friday, June 6:

- Jobs Report (Employment Situation Summary) – May: The centerpiece of the week.

- Strong jobs growth: Could cool gold for a moment, but structural cracks would soon revive demand.

- Weak data: Will turbocharge gold’s safe-haven status.

- Wages: High wage growth fuels inflation concerns—another boost for metals.

The Bottom Line: Physical Gold and Silver—The Ultimate Hedge

Each of these data points is a window into an economy that’s creaking under the weight of debt, trade disruptions, and policy mistakes. But through it all, physical gold and silver remain timeless. They’re not manipulated by central banks, not subject to algorithmic trade routes, and not vulnerable to digital overreach. They’re real, and they’re yours—forever.

Protect Your Wealth—Take Action Today

At Brighton Enterprises, we believe in safeguarding your future with real, physical gold and silver coins—numismatic treasures that stand the test of time and the rigged games of the financial elite. Visit us at brightongold.com or call us at 844-459-0042 to secure your financial sovereignty today.