The calm in today’s markets may not tell the full story. Underneath steady headlines lie complex crosscurrents—shifting monetary policy, geopolitical uncertainty, and structural fiscal challenges. Gold’s recent pullback isn’t a retreat, but a natural pause after a record-setting run. With critical inflation data on deck this week, conditions are setting up for the next potential move higher. For those holding tangible assets, the groundwork is in place. For others, it may be time to take a closer look.

WEEKLY MARKET RECAP: TURBULENCE, TARIFFS, AND THE TREMORS OF STAGFLATION

Monday, May 5

Gold futures soared to $3,318.20 (+$74.90) as China’s retail market ramped up safe-haven demand. While Western traders toyed with speculative pullbacks, Chinese buyers were loading up. Silver edged to $32.155 (+$0.166). With the Fed decision looming midweek, tensions grew.

Tuesday, May 6

Gold rocketed to $3,405.40 (+$82.70), with silver up to $33.045 (+$0.84). Trump’s trade rhetoric returned, dashing any hopes of U.S.-China harmony. The Shanghai Gold Exchange’s move into Hong Kong shows the East wants more control of gold valuation. The dollar weakened, crude rose, and the winds of change intensified.

Wednesday, May 7

Prices retreated slightly on profit-taking: gold to $3,393.90 (–$28.90), silver to $32.785 (–$0.596). The Fed held rates steady, calling the economy “solid” while acknowledging inflation and labor risks. The press conference carried more weight than the decision—Powell played it cautious, but the message was clear: the Fed’s running out of room.

Thursday, May 8

A brief rally in global risk appetite pushed gold down to $3,351.50 (–$40.40), silver to $32.575 (–$0.216). Optimism over a possible U.S.-U.K. trade deal and a firmer dollar put a temporary lid on safe-haven demand.

Friday, May 9

A rebound brought gold to $3,337.30 (+$31.30), with silver at $32.755 (+$0.138). The dollar weakened again, crude rose, and gold showed its resilience. But yields on Treasuries continued climbing, revealing the unease beneath the surface.

NEXT WEEK’S FULL ECONOMIC CALENDAR: MAY 12–16, 2025

Monday, May 12

- No major data releases scheduled

Tuesday, May 13

- 8:30 AM ET: Consumer Price Index (CPI) – April

Measures changes in the price of a consumer basket, a core inflation gauge.

Wednesday, May 14

- 5:40 PM ET: San Francisco Fed President Mary Daly Speech

Potential insight into monetary policy direction.

Thursday, May 15

- 8:30 AM ET: Initial Jobless Claims – Week Ending May 10

Leading indicator of labor market health. - 8:30 AM ET: U.S. Retail Sales – April

Tracks consumer spending, a key growth component. - 8:30 AM ET: Producer Price Index (PPI) – April

Wholesale-level inflation indicator. - 8:30 AM ET: Empire State Manufacturing Survey – May

Snapshot of regional manufacturing in NY. - 8:30 AM ET: Philadelphia Fed Manufacturing Survey – May

Mid-Atlantic factory health. - 9:15 AM ET: Industrial Production & Capacity Utilization – April

Factory output and operational efficiency.

Friday, May 16

- 8:30 AM ET: Import Price Index – April

Measures inflation from overseas goods. - 8:30 AM ET: Housing Starts & Building Permits – April

Indicators of housing market strength. - 10:00 AM ET: Consumer Sentiment (Prelim) – May

University of Michigan’s early consumer confidence reading.

POLICY SHIFTS AND PRECIOUS METALS: BIG PICTURE DEVELOPMENTS

New Hampshire Legalizes Bitcoin as a State Reserve Asset

In a historic shift, New Hampshire has become the first U.S. state to legally recognize Bitcoin as an official reserve asset, alongside gold and silver. Governor Kelly Ayotte signed HB302 into law on May 6, authorizing the treasury to hold cryptocurrencies with a market cap exceeding $500 billion.

This follows years of stalled crypto legislation in Arizona and Florida. But New Hampshire’s move is not isolated. At the federal level, Trump’s administration is drafting a “Digital Fort Knox” strategy—potentially funded by revaluing the physical gold already held in Fort Knox.

Why This Matters:

This sets the precedent for broader reserve diversification across states. More importantly, it positions precious metals and select digital assets—not fiat—as the future foundations of government balance sheets.

Bank of America: $4,000 Gold Is Within Reach

Bank of America has boldly revised its gold target to $4,000 per ounce by year-end, citing structural drivers:

- Investment demand must rise by 18% YoY, as it did in 2016 and 2020.

- Tariffs, geopolitical instability, and America’s fiscal burden continue to favor gold.

- Treasuries offer diminishing returns as real yields stagnate and inflation persists.

Why This Isn’t Just Hype:

Gold’s momentum isn’t about short-term sentiment or seasonal demand—it’s being fueled by deeper economic trends. With the national debt now exceeding $37 trillion and annual interest costs approaching $2 trillion, the fiscal landscape is under growing strain. In this environment, gold continues to stand out—not only as a hedge, but as a stable, long-term asset in an increasingly complex financial system.

The Fed Holds Firm—But The Pressure Is Mounting

The Federal Reserve kept rates unchanged at 4.25%–4.50% for the third straight meeting. Chair Powell pointed to a “solid economy,” but flagged elevated risks from tariffs, inflation, and labor slack.

Despite rising pressure to cut rates amid slowing growth, the Fed is signaling caution over action. Markets have now priced out cuts through the summer.

Why This Matters for Metals:

The Fed’s hesitancy tells us all we need to know: they’re waiting for clarity they can’t find. In the meantime, every delay compounds systemic vulnerabilities—particularly if inflation data surprises to the upside.

IMPACT ON GOLD AND SILVER: WHAT NEXT WEEK’S DATA COULD UNLEASH

The trifecta of inflation metrics—CPI, PPI, and import prices—will be crucial. Here’s how each event could swing precious metals:

- Consumer Price Index (May 13):

- Hot CPI: Sparks expectations of more rate hikes. Gold may briefly retreat, but long-term holders will see this as a buying opportunity.

- Cool CPI: Supports Fed inaction or future cuts. Metals likely rally sharply.

- Producer Price Index (May 15):

- High PPI: Suggests price pressures are filtering upstream. Bullish for gold.

- Low PPI: Reduces pressure on the Fed—moderately supportive.

- Import Prices (May 16):

- Rising Import Costs: Suggest tariffs are inflating costs. Gold surges as inflation fears spike.

- Stable/Falling: Bearish short-term, but longer-term gold remains supported by structural risk.

- Retail Sales (May 15):

- Strong Sales: Hawkish signal, pressures metals.

- Weak Sales: Points to demand weakness, aiding gold.

- Jobless Claims (May 15):

- Higher claims: Weak labor market = safe-haven demand.

- Lower claims: Supports dollar, modest drag on metals.

- Housing Data (May 16):

- Soft housing market: Reinforces slowdown narrative—gold up.

- Strong numbers: Temporary relief for markets, gold sideways or down.

- Consumer Sentiment (May 16):

- Low sentiment: Bullish for gold. Fear drives flight to safety.

- High sentiment: Temporary risk-on, metals may dip.

CROSS’S CONVICTION: THE METAL IS STRONG—AND THE SYSTEM IS UNDER PRESSURE

What we’re seeing today is a pause framed as patience. But beneath the surface, the policy toolkit is growing thinner. Federal spending continues to rise, debt accumulation shows no signs of slowing, and inflation remains an unresolved challenge.

Meanwhile, institutional shifts speak volumes: a U.S. state is diversifying into gold and Bitcoin reserves, major financial firms are raising their outlook for metals, and the Fed is navigating a tightening cycle with limited flexibility.

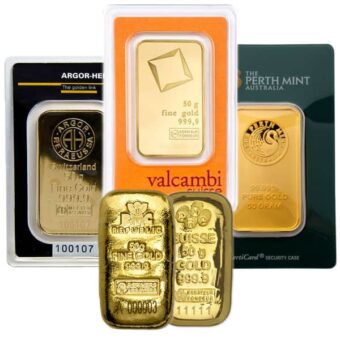

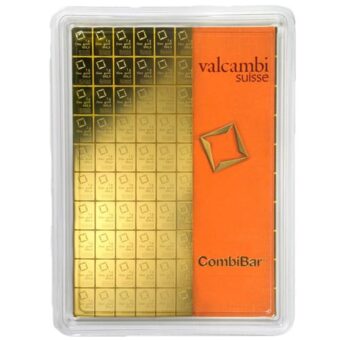

The message is clear—economic landscapes are evolving. Now is an ideal time to reassess your approach and build lasting value through real, tangible assets.

CALL TO ACTION: TAKE CONTROL OF YOUR FUTURE TODAY

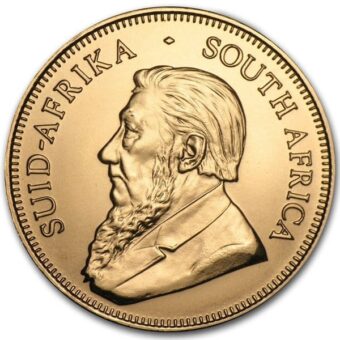

Brighton Enterprises is here to help you reclaim financial sovereignty. Call 844-459-0042 or visit us at brightongold.com to discover how to move into physical gold and silver before inflation, uncertainty, and digital control reach full throttle.

Whether you’re looking for numismatic U.S. coins, storage solutions, or just the truth—we’ve got your back.

We are not financial advisors. This content is for informational purposes only and should not be construed as financial advice. Please consult with a licensed professional for personalized guidance. This publication adheres to all SEC laws, rules, and guidelines.