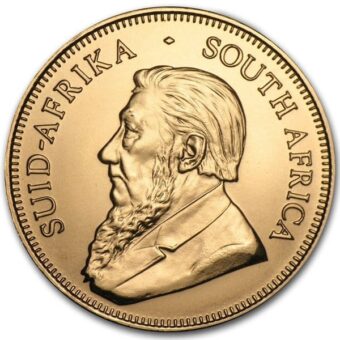

In a week shaped by the collision of geopolitical tremors and economic uncertainty, precious metals traced the path of shifting sentiment. When the stakes are high and clarity is scarce, it becomes all the more important to understand what drives real stores of value. Here’s your comprehensive look at why gold and silver continue to stand apart in a world defined by policy moves and global maneuverings.

Gold and Silver Navigate Another Turbulent Week

Monday – June 23, 2025

Precious metals rose to open the week, reflecting a measured safe-haven response after U.S. airstrikes on Iranian nuclear sites. Gold climbed $21.90 to $3,407.70, while silver edged up to $36.235. Though broader markets were steady, uncertainty over potential retaliation lent underlying support.

Tuesday – June 24, 2025

With a ceasefire declared between Iran and Israel, the metals retreated. Gold fell $69.10 to $3,326.20, silver slipped to $35.645. Equities rallied on optimism, demonstrating how quickly sentiment can swing when headlines shift.

Wednesday – June 25, 2025

Prices bounced back modestly as participants considered the possibility that the ceasefire might not hold. Gold added $8.20, closing at $3,342.10. Silver rose to $36.08, while consumer confidence data revealed a clear undercurrent of concern about tariffs and inflation.

Thursday – June 26, 2025

Gold stayed essentially flat, supported by a weaker dollar but held in check by easing geopolitical risk. Silver rose $0.449 to $36.545. Many opted to wait for the week’s economic data before taking larger positions.

Friday – June 27, 2025

As trade deal optimism spurred equities to fresh highs, metals sold off. Gold dropped to a four-week low of $3,286.30, and silver fell nearly 2%. Even in retreat, metals remained within their recent ranges, underscoring their role as ballast when other assets are in motion.

Gold Struggles Below $3,300 Even as Inflation Climbs

Broader Perspective

Hotter-than-expected inflation readings failed to rekindle sustained buying. Core PCE rose 2.7% year-over-year in May, but gold closed lower as concerns about stagflation mingled with waning safe-haven demand.

Context

Personal income fell by 0.4%, and spending declined by 0.1%. Gold settled at $3,272, reflecting caution amid competing crosscurrents.

Why This Matters

Persistent inflation, coupled with soft consumption, reinforces why metals remain an essential alternative. When currency purchasing power is eroded, people inevitably reconsider the role of tangible assets.

Key Takeaway

Until monetary policy pivots decisively, gold may remain rangebound—though the conditions forming now often precede a meaningful shift in longer-term demand.

Musk’s Efficiency Drive Faces Institutional Inertia

Broader View

Elon Musk’s Department of Government Efficiency aimed to slash trillions in federal waste but ran headlong into the entrenched bureaucracy of Washington. Early momentum gave way to legislative compromises.

Details

Reforms targeting foreign aid and education were reversed or watered down. Musk publicly acknowledged that structural change would require more than private-sector enthusiasm.

Relevance

This story illustrates a broader principle: relying on centralized institutions to fix themselves has limits. When it comes to preserving value, physical assets remain beyond the reach of policy reversals.

Conclusion

DOGE’s struggles are a reminder that self-sufficiency, rather than waiting on systemic reforms, is a more durable strategy for building security.

Gold Stays Firm as Focus Shifts to Federal Reserve Strategy

Big Picture

Even as ceasefire developments calmed immediate fears, gold posted moderate gains. August futures closed at $2,347.00, up $8.60, with the U.S. Dollar Index declining modestly.

Developments

Fed Chair Powell’s testimony underscored a data-driven approach, hinting that tariffs could lift prices but describing the effects as potentially transitory.

Why It Matters

This pivot—from reacting to geopolitical headlines to interpreting monetary policy—demonstrates how metals are increasingly being used as a stabilizing element in portfolios.

Bottom Line

Gold’s resilience signals its enduring role as a store of value when policy clarity remains elusive.

Gold Stays Rangebound Despite Weak Housing Figures

Overview

New home sales contracted by 14% month-over-month in May, but metals didn’t budge. Instead, traders appeared content to await more decisive catalysts.

Details

Spot gold traded flat at $3,321.64, while inventories of unsold homes continued to grow. Historically, housing softness foreshadows broader weakness, which may eventually support precious metals.

Takeaway

While not an immediate trigger, softening housing can set the stage for renewed demand for real assets as a buffer against the next downturn.

Key Economic Events Ahead: June 30 – July 4, 2025

Here’s what to watch next week—and why it could shape precious metals markets:

Tuesday, July 1

S&P Final U.S. Manufacturing PMI (June)

Impact on Precious Metals:

A downward revision may highlight slowing industrial momentum, prompting people to consider gold as a hedge against deceleration. Strong figures could dampen metals by reinforcing expectations of continued tightening.

JOLTS Job Openings (May)

Impact on Precious Metals:

A decline in open positions might suggest labor market cooling, supporting gold as a stabilizer. Elevated openings could sustain wage pressure, counteracting metals by bolstering the growth outlook.

ISM Manufacturing Index (June)

Impact on Precious Metals:

Contraction would likely rekindle safe-haven interest, while a robust print could weigh on gold and silver by signaling resilience.

Wednesday, July 2

ADP Employment Report (June)

Impact on Precious Metals:

Soft private-sector hiring could lift metals by shifting expectations toward a more accommodative Fed. Strong job creation may temporarily pressure prices lower.

Thursday, July 3

Initial Jobless Claims (Week Ending June 28)

Impact on Precious Metals:

Rising claims would point to growing strain in the labor market, often a tailwind for gold. Lower claims would keep upward pressure on yields, limiting metals’ near-term upside.

Employment Situation Report (June)

Impact on Precious Metals:

This is the marquee data point of the week. Weak payrolls or higher unemployment could drive renewed buying of gold and silver. Strong wage growth and robust hiring would likely favor the dollar, applying headwinds.

S&P Final U.S. Services PMI (June)

Impact on Precious Metals:

A downward revision may add to recessionary concerns, supporting metals. Conversely, an upward revision could reinforce optimism, weighing on safe-haven flows.

ISM Services Index (June)

Impact on Precious Metals:

Weakness here could be the final nudge toward a more defensive stance, favoring gold. A strong report would embolden risk appetite, keeping metals in consolidation.

Friday, July 4

Independence Day – Markets Closed.

Closing Thoughts

This past week serves as a vivid illustration of how swiftly narratives evolve. Even in periods of short-term softness, precious metals remain one of the few assets rooted in something tangible—untethered from shifting policies and institutional complexity. As new data unfolds, the case for owning physical gold and silver continues to be about one thing above all else: control over what’s yours.

Ready to Learn More?

Explore additional insights and discover how precious metals can become a cornerstone of your self-sufficiency. Visit brightongold.com or call 844-459-0042 to speak with our team.

Disclaimer

We are not financial advisors. This content is for informational purposes only and should not be construed as financial advice. Please consult with a licensed professional for personalized guidance. This publication adheres to all SEC laws, rules, and guidelines.